Landen corporation uses a job-order costing system – Landen Corporation’s adoption of a job-order costing system serves as a compelling case study, showcasing the nuances and significance of this costing method. Job-order costing, a meticulous approach to tracking costs associated with specific production jobs or orders, plays a pivotal role in Landen Corporation’s operations.

Through this comprehensive exploration, we delve into the intricacies of job-order costing, examining its advantages and limitations, unraveling the processes of cost accumulation and allocation, and scrutinizing the methods employed to calculate job costs. Furthermore, we uncover the significance of cost reconciliation in ensuring accuracy and identifying variances, ultimately shedding light on the crucial role job-order costing plays in financial reporting and inventory valuation.

1. Job-Order Costing System at Landen Corporation: Landen Corporation Uses A Job-order Costing System

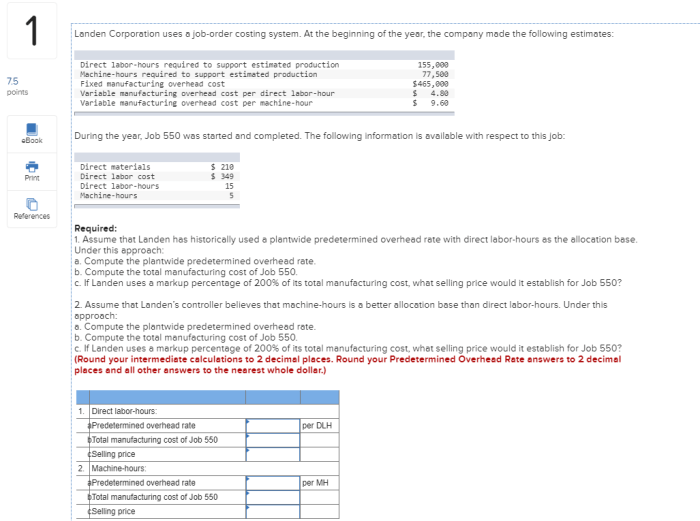

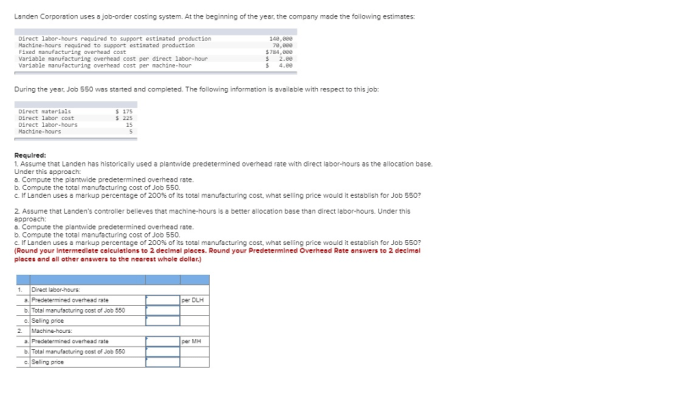

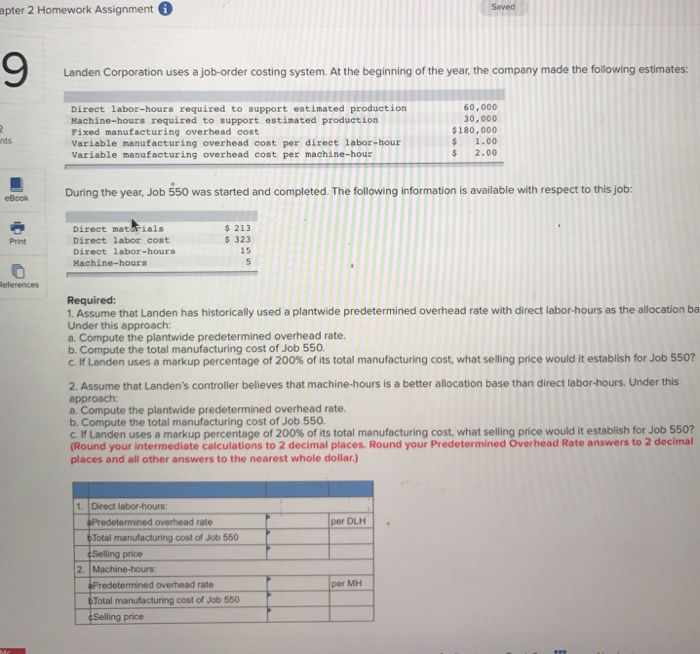

Landen Corporation utilizes a job-order costing system to accumulate and allocate costs associated with the production of unique customer orders. This system is particularly suited to businesses that manufacture products on a customized basis, as it enables the tracking of costs for each individual job.

The primary advantage of a job-order costing system lies in its ability to provide detailed cost information for specific products or orders. This information is crucial for pricing decisions, profitability analysis, and product costing.

However, job-order costing also has its drawbacks. It can be complex and time-consuming to implement, especially for businesses with a high volume of orders. Additionally, it requires a significant amount of data collection and record-keeping, which can increase administrative costs.

2. Cost Accumulation and Allocation

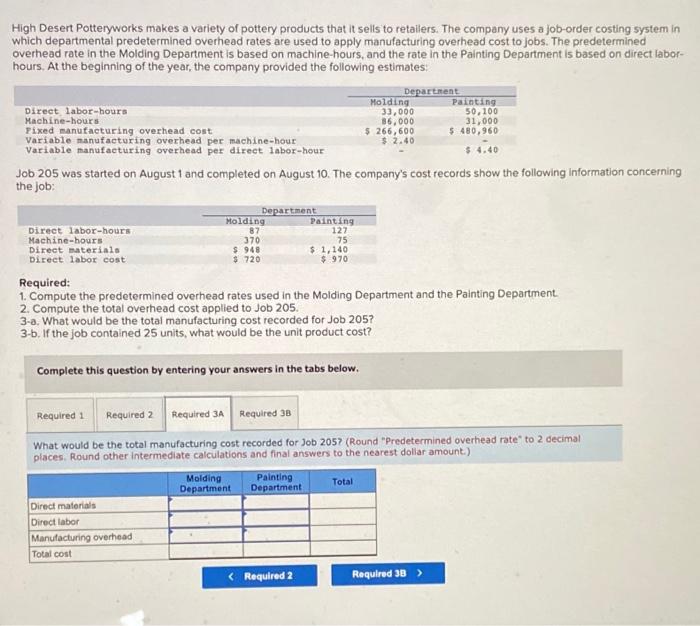

In a job-order costing system, costs are accumulated and allocated to specific jobs or products. This process involves three main steps:

- Identification of Costs:The first step is to identify all costs that are directly or indirectly related to the production of a particular job. These costs may include direct materials, direct labor, and manufacturing overhead.

- Accumulation of Costs:Once the costs have been identified, they are accumulated in separate cost pools for each job. This process ensures that all costs associated with a particular job are tracked together.

- Allocation of Costs:The final step is to allocate the accumulated costs to the specific products or orders. This allocation is typically based on a predetermined cost driver, such as direct labor hours or machine hours.

Job-order costing systems use two primary methods to calculate job costs: actual costing and normal costing. Actual costing uses actual costs incurred during the production process, while normal costing uses predetermined overhead rates to estimate overhead costs.

3. Cost Reconciliation

Cost reconciliation is a process of comparing actual costs with estimated costs in a job-order costing system. This process helps to identify any variances between the two and determine the underlying causes.

The most common method of cost reconciliation is to use a cost variance report. This report compares actual costs to budgeted or standard costs and provides an analysis of the variances.

Cost variances can be caused by a variety of factors, including changes in material prices, labor rates, or production efficiency. By analyzing these variances, management can identify areas where costs can be reduced and improve the accuracy of future cost estimates.

4. Financial Reporting

Job-order costing data is used to prepare financial statements, including the income statement and balance sheet. The income statement reports the revenue and expenses associated with each job, while the balance sheet reports the assets and liabilities of the company, including the value of work in progress and finished goods.

Job-order costing has a significant impact on income measurement and inventory valuation. The timing of revenue recognition and expense recognition is affected by the job-order costing system used.

Financial statements provide users with information about the financial performance and position of a company. Job-order costing data is an essential component of these financial statements.

5. Case Study

Landen Corporation’s Job-Order Costing System

Landen Corporation is a manufacturing company that produces a variety of custom-made products. The company uses a job-order costing system to track the costs associated with each job.

Landen Corporation’s job-order costing system is designed to provide accurate and timely cost information for decision-making. The system is integrated with the company’s financial accounting system, which ensures that the financial statements are accurate and reliable.

The effectiveness of Landen Corporation’s job-order costing system is evident in the company’s financial performance. The company has been able to consistently meet customer demand, maintain profitability, and control costs.

Questions Often Asked

What are the key advantages of using a job-order costing system?

Job-order costing provides accurate costing information for specific jobs or orders, facilitates better cost control, enhances profitability analysis, and supports informed decision-making.

How does Landen Corporation allocate costs to specific jobs?

Landen Corporation utilizes a combination of direct costing, where costs are directly traced to jobs, and indirect costing, where overhead costs are allocated based on predetermined rates.

What methods are used to calculate job costs in a job-order costing system?

Actual costing, which assigns actual costs incurred to jobs, and normal costing, which applies predetermined overhead rates, are commonly used methods for calculating job costs.